Energy Assistance

The Maryland Energy Assistance Program (MEAP) provides financial assistance with home heating bills. Payments are made directly to the fuel supplier and energy company on the customer’s behalf.

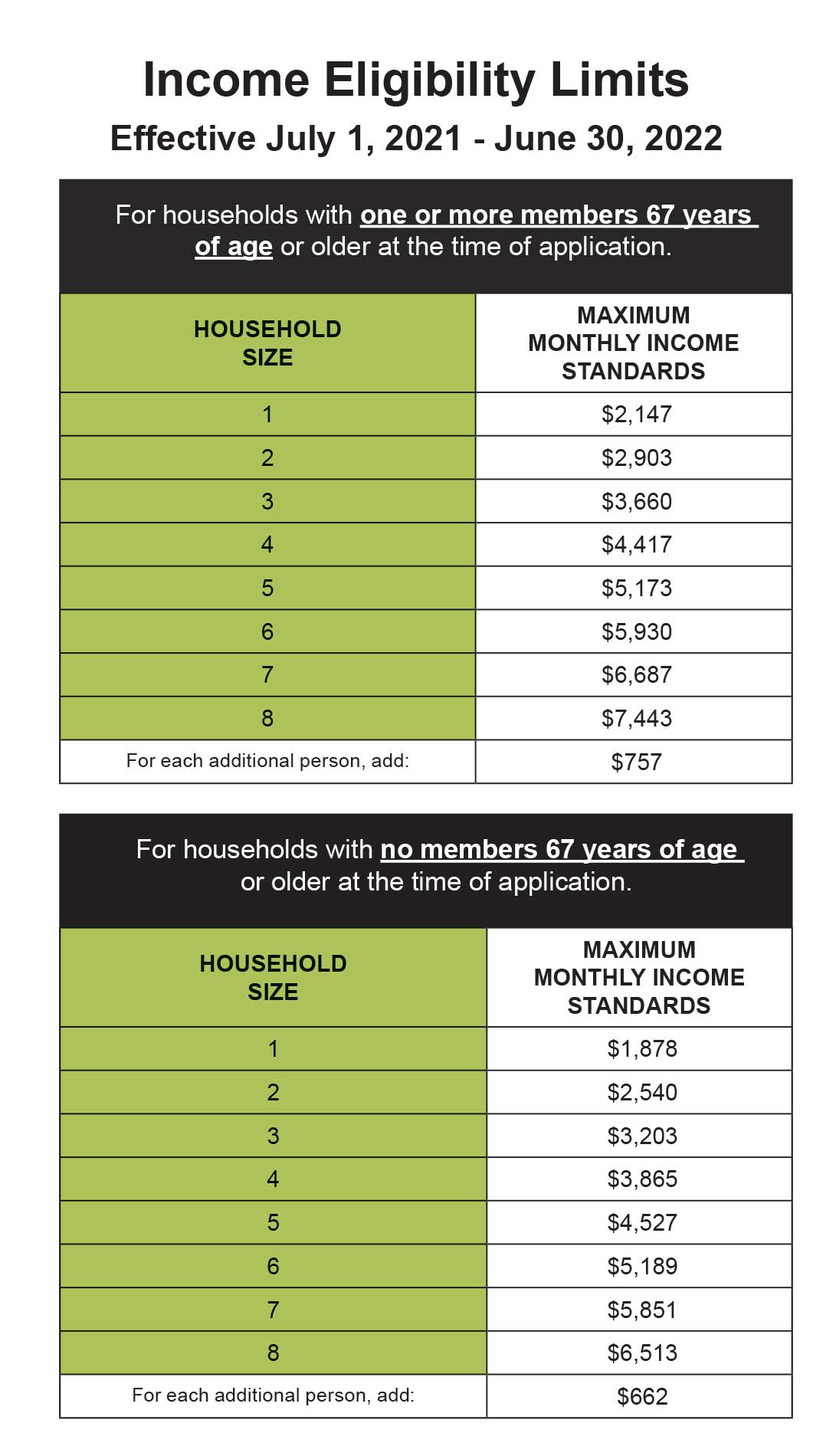

Renters, homeowners, residents of public housing, sub-metered homes (where you pay another company, not the utility directly), Roomers/ Boarders are all eligible for Energy Assistance grants. The most important factors in determining who is eligible for energy assistance are the size of your household and how much money you made in the last 30 days. Our income eligibility guidelines are below:

Many Energy Assistance offices, particularly in Baltimore City, Montgomery County, and Prince George’s County where the virus has hit the hardest, have secure drop boxes available to receive your application and documents.

To apply by mail, you can request an application be mailed to you, or print a copy of the application and mail it, along with all of your documents to your local Energy Assistance office. To see a full list of locations please visit:

Energy Assistance offices can accept applications over the phone. However, you will need to email or mail your documents to the local office after your information has been taken. Energy assistance does not need documents to be scanned, we can accept clear pictures of your documents where text is visible.

Since many of our offices also process applications for other social services programs (Food Stamps, TCA, etc), it may take a while to get an in-person appointment. However, due to local COVID-19 restrictions, some offices are not offering appointments. Call your local office to see if they are scheduling appointments.

OHEP provides assistance to help you afford your energy bills. The benefit provided is based on your household income, how many people live in your household, and how much energy your household uses. To determine your benefit, OHEP needs information to prove:

Energy Assistance can help you pay down an outstanding balance on your current electricity or heating bill. While we are not able to help with closed accounts, we are able to help with costs necessary to start or continue your electric or heating service.

No. The Office of Home Energy Programs works closely with all Maryland utilities and heating companies to make sure our team is getting the most up-to date balances on every applicant’s account. Your payment plan will not prevent you from receiving the full benefit you qualify for.

No! Do not wait until you have a turn o ff notice to apply! We can help prevent you from receiving a turn o ff notice if you apply before you receive one.

Energy Assistance grants can be used to pay for:

Submitting an application without all of your documents will slow down the application process significantly. For the quickest service, please include all of your documents when you submit your application, no matter how you submit your application.

Unfortunately, utilities do not automatically know that you are applying for Energy Assistance. Utilities are notified that you are working with Energy Assistance when we place a hold on your account or commit to paying certain amounts to your account.

Yes! You can receive Energy Assistance benefits no matter what your situation is. If you are responsible for paying for your energy and heating costs, you are eligible for energy assistance.

Visit https://myohepstatus.org/ to see the status of your application. Since this site is updated when your local office has started working on your application, please allow 15 days for your application to show up on the site. You can also call the DHS call center or local office for updated information.

Every application is different because every household is different. If there are issues with the documents you provided with your application, there will be a delay as your local office tries to contact you. We are required to:

Please understand that this year we will receive more applications than we have in the past, so some processing delays are expected in highly populated areas.

All OHEP offices have secure drop-boxes to receive your application. You can find your local office by visiting: https://dhs.maryland.gov/office-of-home-energy-programs/local-home-energy-program-office/

Some of our local offices are currently accepting walk-in appointments. However because Maryland is still dealing with COVID-19, offices may be forced to close if there is a diagnosed case of COVID-19 among staff or recent visitors.

Always call ahead to your local offices to find out their process for handing in-person applications.

You can apply for Energy Assistance online or by contacting your local Energy Assistance office. A full list of offices can be found on our website: https://dhs.maryland.gov/office-of-home-energy-programs/local-home-energy-program-office/

Your energy assistance application must be processed by your local office. If you submit your application to another office in another county, it will cause a delay in processing your application as it is sent to the right office. Your application will only be processed when the application was received by the correct office in your local jurisdiction.

There are a lot of reasons why your bill may be high since every home is different, some common reasons for high bills are:

You can find out more about what is driving up your energy bill by checking your bill each month. Most utility companies show you how much energy you’re using each month on your bill, with many providing periodic reports for when you use energy the most.

If you are worried that your bill is high because your home is drafty, make sure you choose the “Energy Efficiency for Your Home– DHCD Efficiency Programs” on your Energy Assistance application.

Call your local OHEP office to request an application and call your utility to discuss the status of your account. When you speak with the local OHEP office, tell them that your electric has been turned off. You may need additional resources to restore electric service if Energy Assistance grants are not enough. You may have to work with your utility to make additional arrangements to pay the remaining balance on your account. In light of the impact of the COVID-19 epidemic, all Maryland utility companies are offering payment plans for a minimum or 12 months, or for up to 24 months if you receive Energy Assistance.

If Energy Assistance alone cannot have your service turned back on, you may be eligible additional resources to pay o your energy bill:

Certain benefits can significantly reduce or eliminate old balances on your account and lower your bill moving forward. Benefits will not necessarily cover your entire bill.

We will send you letters if we need information from you and to let you know the final status of your application. Some offices may also call you to ask for more information about your application.

“Household” means an individual or group of individuals who are living together as one unit and for whom residential energy is customarily purchased in common or who make undesignated payments for energy in the form of rent.

Income eligibility is based on all gross (before taxes and other deductions) income received by everyone in the household over the age of 18 during the 30 days preceding the date of application. Income for full-time students is not counted as income if the student’s full-time status is documented. If an applicant receives income monthly from SSI, SSA, wages or a pension, but the income is received within the month, but not received within 30 days, the income is still counted. Example: If the employee applies on April 1st and the last paycheck was received on March 1st, that paycheck is counted.

Your most recent tax form Schedule SE is the best and easiest way to document your income if you are self-employed. Your income reported on the Schedule SE will be divided by 12 to get your 30-day income. In addition to the tax form, self-employed individuals must also complete and sign the Income Verification of Self-Employment form, found here: https://dhs.maryland.gov/documents/DHR%20Forms/ FIA%20Forms/English/OHEP/Income%20Veri cation% 20of%20Self-Employment.pdf .

If you have not filed taxes but are self-employed, For applicants who have not filed taxes, your income must still be documented. You can provide weekly, monthly and/or quarterly books/statements, ledgers, sales slips, cancelled checks, invoices, bank statements/deposits for the last 30 days.

All household members 18 and over who claim zero income was received for the last 30-day application period must complete a Declaration of Zero Income form. A household worksheet must be completed to document how your household is meeting basic needs during the time of having no income. Household Worksheet. If it is indicated on the Household Worksheet that someone is assisting you in meeting the household’s basic needs a Resource Provider Statement must be completed.

The Utility Service Protection Program (USPP) protects low-income families from utility cut-off s and allows MEAP eligible households to enter into a year-round even monthly payment program with their utility company. An equal monthly payment plan based on the estimated cost of the customer’s average annual utility usage minus the MEAP benefit will be used to determine the even monthly payments for participation in the USPP.

Arrearage Retirement Assistance benefits (the grants we use to pay off past-due balances) can only be received once per seven year period. Households that contain vulnerable members may be eligible to receive the benefit again if the household has:

If you apply for an Arrearage Retirement grant before, your local Energy Assistance office will automatically review your application to see if you are eligible to receive this benefit again.